Gifts of stock

You can make a significant gift to the environment.

Sierra Club Canada – Events

You can make a significant gift to the environment by donating securities (in the form of stocks or mutual funds) directly to us.

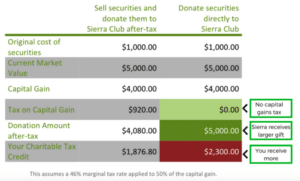

Donors who transfer securities directly to charities are exempt from the capital gains tax, making this type of donation very beneficial to both the donor and the charity. Here’s how it works:

- To avoid incurring a capital gains tax, donors can transfer their securities directly to Sierra Club Canada Foundation.

- We then promptly sell the securities after the transfer.

- The donor avoids the capital gains tax, and we benefit from an immediate and significant gift.

- You will receive a tax receipt for the full market value of the shares on the day the securities are transferred to Sierra Club Canada Foundation.

Here’s an example:

Gift of Securities scenario chart

To transfer securities to our TD Direct Investing account, here are the steps:

1. If you are choosing to transfer securities electronically (whether you bank with TD or another financial institution), you/your banking institution will require Sierra Club’s investing account information below:

Account #: 21-B1RR-A

Account name: Sierra Club Canada Foundation

CUID: GIST

DTC: 5036

CRA Charity Registration #: 11914 9789 RR0001

Name of Financial Institution: TD Direct Investing

- If you are, in fact, a TD Bank client, and if you are choosing to manually transfer funds please contact us.

- If you are a non-TD Bank client, and wish to transfer fundsmanually, provide the above account information to your banking institution.

If you intend to donate securities, please feel comfortable in providing advance notice to:

Beti Canet

Development Manager

email: development@sierraclub.ca